Rendered at 05:17:52 09/12/25

Envío gratis

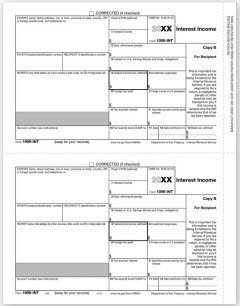

EGP 1099-INT, IRS Approved, Laser Recipient Copy B, 50 Sheets@ Forms

$359.00 MXN

Los buques de

United States

Las opciones de envío

Los buques de 1-4 business days Detalles

No hay precio de envío se especifica en MX

Los buques de

United States

La política de devoluciones

Refunds available: See booth/item description for details

Protección de compra

Opciones de pago

PayPal accepted

PayPal Credit accepted

Venmo accepted

PayPal, MasterCard, Visa, Discover, and American Express accepted

Maestro accepted

Amazon Pay accepted

Nuvei accepted

Las opciones de envío

Los buques de 1-4 business days Detalles

No hay precio de envío se especifica en MX

Los buques de

United States

La política de devoluciones

Refunds available: See booth/item description for details

Protección de compra

Opciones de pago

PayPal accepted

PayPal Credit accepted

Venmo accepted

PayPal, MasterCard, Visa, Discover, and American Express accepted

Maestro accepted

Amazon Pay accepted

Nuvei accepted

Rasgos del artículo

| Categoría: | |

|---|---|

| cantidad disponible: |

999 En stock |

| Condition: |

New |

| Model: |

TF5121 |

| MPN: |

TF5121 |

| ASIN: |

B002HFRNQK |

| binding: |

Office Product |

| format: |

Office Product |

| Brand: |

EGPChecks |

| color: |

White with Black Ink |

| manufacturer: |

EGP |

| Material Type: |

20 Pound Tax Form Stock |

| Package Quantity: |

100 |

| Part Number: |

TF5121 |

Detalles del anuncio

| Las políticas del vendedor: | |

|---|---|

| Publicado en venta: |

Más de una semana |

| Artículo número: |

1289419132 |

Descripción del Artículo

File Form 1099-INT, Interest Income, for each person to whom you paid amounts reportable in boxes 1, 3, and 8 of at least $10 (or at least $600 of interest paid in the course of your trade or business described in the instructions for Box 1. Interest Income), for whom you withheld and paid any foreign tax on interest, or from whom you withheld (and did not refund) any federal income tax under the backup withholding rules regardless of the amount of the payment. Report only interest payments made in the course of your trade or business including federal, state, and local government agencies and activities deemed nonprofit, or for which you were a nominee/middleman. Report tax-exempt interest, only on Form 1099-INT. You do not need to report tax-exempt interest that is original issue discount (OID). Report interest that is taxable OID on Form 1099-OID not on Form 1099-INT.

Ships direct from the plant

Added to your wish list!

- EGP 1099-INT, IRS Approved, Laser Recipient Copy B, 50 Sheets@ Forms

- 999 in stock

- Handling time 4 day.

- Returns/refunds accepted

Get an item reminder

We'll email you a link to your item now and follow up with a single reminder (if you'd like one). That's it! No spam, no hassle.

Already have an account?

Log in and add this item to your wish list.